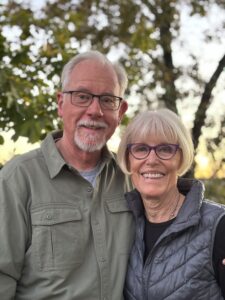

Donors Michael and Janet Verlander share how donating appreciated assets can amplify your support for Russian Riverkeeper while providing significant tax benefits.

Donors Michael and Janet Verlander share how donating appreciated assets can amplify your support for Russian Riverkeeper while providing significant tax benefits.

By donating long-term appreciated securities or other non-publicly traded assets such as real estate and limited partnerships directly to the Russian Riverkeeper, you can maximize your support AND your tax benefits.

- You will be able to eliminate the 20% capital gains tax and the 3.8% Medicare surtax on the appreciation of the asset.

- If you itemize deductions, you will receive an income tax deduction in the full amount of the fair-market value. At the maximum marginal tax rates, this would reduce your US taxes by 37% and your California taxes by 9.3% and up to 13.3% of the fair-market value of your donation.

This approach allows you to make an even bigger impact with your gift while maximizing your tax benefits—a true win-win!